Navigating the UPC: An In-Depth Analysis of Opt-Outs so far

Whether or not to opt-out of the UPC has been one of the most hotly debated aspects in the lead-up to the new court system. Despite the UPC taking so long to arrive, there still does not seem to be one “correct” approach and it is clear that patent holders are taking very different approaches.

10 May 2023 by Simmons + Simmons LLP

Based on wide-ranging discussions with proprietors, intentions spread from opting everything out, to leaving everything in, and every option in between. Whatever the individual approach, with some organisations mooting up to a million opt-outs before the Court opens it was always going to be a busy period for representatives and, perhaps more relevantly, the UPC’s IT teams. Other than some initial road-bumps and restrictions, everything from an IT perspective seems to be going smoothly, albeit in recent days the UPC Case Management System seems to be struggling under the load.

The UPC’s IT systems provide interfaces for automated filing of opt-outs, and also for accessing data on cases, including opt-outs. We can therefore obtain a near-live view of many aspects of activity at the UPC. This article looks at the data we can view on representative registrations and opt-outs, to see if we can draw any initial conclusions or trends.

Representatives

As of 5 May 2023 2,817 people have registered as representatives at the UPC, from 29 countries.

Looking at qualification type, we see the vast majority are “other”, which we expect are mainly patent attorneys relying on their EPO qualification and national litigation rights. Entitlement based on a European Patent Litigation Certificate (EPLC) should not appear as there are currently no formally approved EPLC courses, and we understand the UPC are contacting representatives who used this designation to correct it.

Perhaps unsurprisingly, Germany are leading the way with 1,127 representatives, but it’s pleasing to see the UK in second place:-

The relatively low number of representatives from Italy, France and the Netherlands is likely due to limited recognition by the UPC of pre-existing qualifications obtainable by European Patent Attorneys in those countries.

Opt-Outs

As of the morning of 5 May 2023 there have been 76,099 cases opted-out of the UPC. Of these, 61,749 are patents and 14,338 are applications (plus 12 unpublished applications) at the time the opt-out requests were filed.

It is almost impossible to reliably say what portion this represents of the total number of cases that could be opted-out. Any published application, plus all granted patents that are in force in at least one UPC state (and there could even be interest in opting out lapsed or expired patents which are in the limitation period) could be opted out. In 2022 over 100,000 patents were granted by the EPO and nearly 200,000 were filed, so the portion opted-out is currently very small.

The inclusion of unpublished applications is interesting as the Rules of Procedure only relate to opting out published applications. Presumably the intention is that the opt-out will become effective when the application is published, but the mechanism for that is not completely clear. Care is needed as the opt-out interface does not prevent an opt-out being filed if a publication number has been assigned but the application not yet actually been published by the EPO (as often occurs for Euro-PCT applications).

Technical Fields

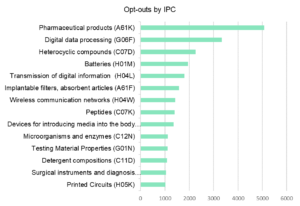

The following chart shows opt-outs by technical area based on the first-mentioned IPC code.

Unsurprisingly in view of industry perceptions of the new system, pharmaceutical inventions appear at the top of the list.

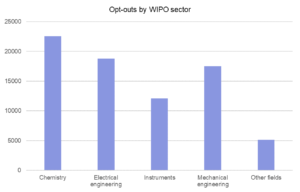

WIPO categorise technologies into five sectors which we can map to from the IPC codes, and that confirms a focus in this area:-

Counting numbers of opt-outs is not an accurate representation of behaviour as there is a wide variation in the number of applications & patents in each sector.

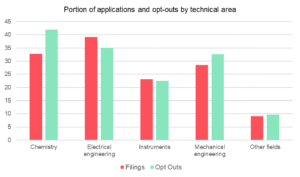

Using EPO data we can see the number of applications filed in each area each year. Taking an average of those numbers from the last 10 years provides an approximation of the number of cases available to opt out. Comparing the portion of filings and opt outs in each technical area, we see chemistry (which includes pharmaceuticals) are opting out a disproportionate number of cases:-

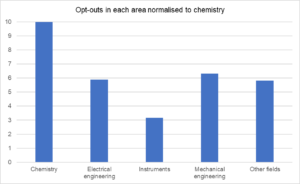

Presenting this in a different way, normalised against chemistry, we can approximate the relative portion of the pool that is being opted out:-

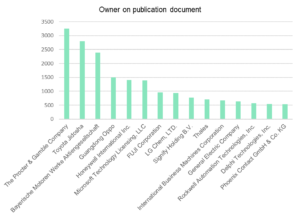

Looking at the name of the applicant or proprietor listed on the publication document for each opted-out case, we see Procter & Gamble in the “lead”:-

Not too much reliance should be placed on the exact numbers presented here as we have not attempted to combine opt-out requests from related entities or group companies, nor to account for assignments since the publication was produced.

Also, these numbers need to be treated with (even more) caution as portfolio sizes vary wildly. We have not been able to devise a sufficiently reliable way to compare the number of opt-out requests by a party relative to number of cases that could be opted out for that name.

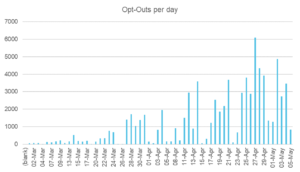

The rate of opt out filing continues to increase so it is hard to predict where we will end up by 1 June. The number of opt-out requests being filed on weekends is noticeably increasing:-

Conclusions

As with most statistics it is possible to draw different conclusions by cutting the data in different ways. The current analysis shows that a large number of proprietors are opting out of the system, but they appear to be taking a considered approach and only removing parts of their portfolios.

One interesting feature of the data, and a possible concern, is the very long “tail”. There are around 4,000 proprietor names which have opted out only a single case. This suggests a large number of proprietors with very small portfolios are opting out. Our question is “why”? The reason to opt-out is avoid the risk of a central attack on a patent, but how many of those 4,000 have ever been involved in litigation, or face any real prospect of their patent being challenged? Without any real risk to their patent there is no need to opt-out. This raises a concern that advisors may be taking an overly cautious approach and advising clients to opt-out when it is not really necessary, incurring significant costs for small companies.